Unlock International Opportunities with Offshore Company Formation

Unlock International Opportunities with Offshore Company Formation

Blog Article

Introducing the Advantages of Opting for Offshore Company Development

Discovering the realm of overseas business development reveals a myriad of advantages that can substantially affect individuals and services alike. From tax benefits to enhanced asset protection, the appeal of overseas firm formation lies in its ability to maximize financial strategies and expand international reach.

Tax Advantages

In addition, overseas companies can engage in tax obligation planning methods that may not be readily available in their residential nations, such as making use of tax treaties between jurisdictions to decrease withholding tax obligations on cross-border transactions. This flexibility in tax obligation planning allows services to boost their global procedures while handling their tax exposure effectively.

Furthermore, overseas firms can take advantage of asset defense advantages, as properties held within these entities may be protected from certain legal insurance claims or lenders. This included layer of protection can guard business properties and maintain riches for future generations. On the whole, the tax obligation benefits of developing an overseas firm can provide businesses an one-upmanship in today's worldwide industry.

Property Security

Enhancing the security of company possessions through critical planning is a key objective of offshore firm formation. Offshore entities give a robust structure for securing properties from potential dangers such as lawsuits, creditors, or political instability in residential territories. By establishing a firm in a stable overseas jurisdiction with beneficial property defense legislations, people and companies can shield their riches from various hazards.

Among the essential benefits of offshore firm development in terms of possession defense is confidentiality. Many offshore jurisdictions use rigorous personal privacy laws that allow companies to maintain privacy concerning their ownership framework. offshore company formation. This privacy makes it testing for external events to recognize and target specific possessions held within the overseas entity

In addition, offshore frameworks usually have stipulations that make it difficult for creditors to access properties held within these entities. Via lawful devices like possession defense depends on or details stipulations in corporate documents, people can include layers of protection to safeguard their wealth from possible seizure.

Increased Privacy

In addition, many overseas territories do not require the about his disclosure of advantageous owners or investors in public records, including an additional layer of privacy protection. This discretion can be specifically useful for high-profile individuals, business owners, and services looking to avoid unwanted attention or shield delicate financial info. In general, the raised personal privacy used by offshore firm formation can give peace of mind and a sense of protection for those seeking to keep their monetary events secure and very discreet.

Worldwide Market Gain Access To

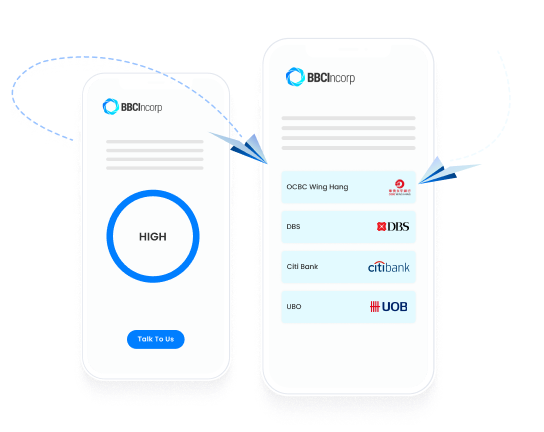

With the establishment of an offshore firm, businesses get the critical benefit of touching into global markets with increased ease and performance. Offshore firm development gives companies with the chance to access a broader client base and discover new business potential customers on an international scale. By establishing operations in offshore jurisdictions understood for their business-friendly laws and tax obligation incentives, business can expand their reach past domestic boundaries.

Worldwide market access with overseas business formation additionally allows services to develop global credibility and existence. Operating from a jurisdiction that is acknowledged for its stability and pro-business setting can enhance the online reputation of the company in the eyes of international companions, financiers, and consumers. This enhanced credibility can open up doors to partnerships, collaborations, and chances that may not have been conveniently accessible via an exclusively residential company strategy.

In addition, overseas companies can take advantage of the diverse range of sources, skills, and market understandings available in different parts of the world. By leveraging these worldwide sources, companies can obtain an one-upmanship and remain in advance in today's vibrant and interconnected organization landscape.

Lawful Conformity

Following legal compliance is important for overseas business to guarantee regulatory adherence and threat mitigation in their procedures. Offshore business should navigate an intricate regulative landscape, often subject to both local regulations in the territory of unification and the international laws of the home nation. Failing to follow these lawful needs can lead to serious consequences, consisting of fines, address lawsuits, or also the revocation of the offshore company's permit to operate.

To keep legal compliance, overseas firms typically engage lawful experts with understanding of both the neighborhood policies in the offshore territory and the international laws appropriate to their operations. These attorneys aid in structuring the offshore business in a way that ensures compliance while making best use of operational effectiveness and success within the bounds of the regulation.

In addition, staying abreast of advancing legal demands is important for overseas firms to adjust their procedures appropriately. By prioritizing legal compliance, overseas firms can build a strong foundation for lasting growth and long-lasting success in the worldwide market.

Final Thought

To conclude, overseas company formation provides more information numerous benefits such as tax benefits, possession protection, raised personal privacy, international market gain access to, and lawful compliance. These benefits make overseas firms an appealing alternative for organizations aiming to broaden their procedures globally and maximize their monetary approaches. By capitalizing on offshore business formation, organizations can enhance their one-upmanship and placement themselves for long-term success in the worldwide market.

The establishment of an offshore company can provide substantial tax obligation advantages for businesses seeking to maximize their financial structures. By establishing up an offshore business in a tax-efficient territory, organizations can legitimately lessen their tax obligation obligations and preserve more of their revenues.

In general, the tax benefits of establishing an overseas firm can provide businesses an affordable edge in today's global market. offshore company formation.

Enhancing the security of business properties via calculated preparation is a key objective of offshore firm development. Offshore firm development offers business with the chance to access a wider customer base and check out new organization potential customers on a worldwide range.

Report this page